FX-Cross: Machine Learning–Driven Trading Signal Generation

Probabilistic FX trading strategies using time series smoothing, machine learning, and deep learning models

This project focuses on the development of a quantitative FX trading framework for major currency crosses, combining classical time series techniques with modern machine learning and deep learning models to generate probabilistic trading signals. The objective is to estimate the likelihood of favorable intraday price movements and construct rule-based trading decisions grounded in statistical and predictive rigor.

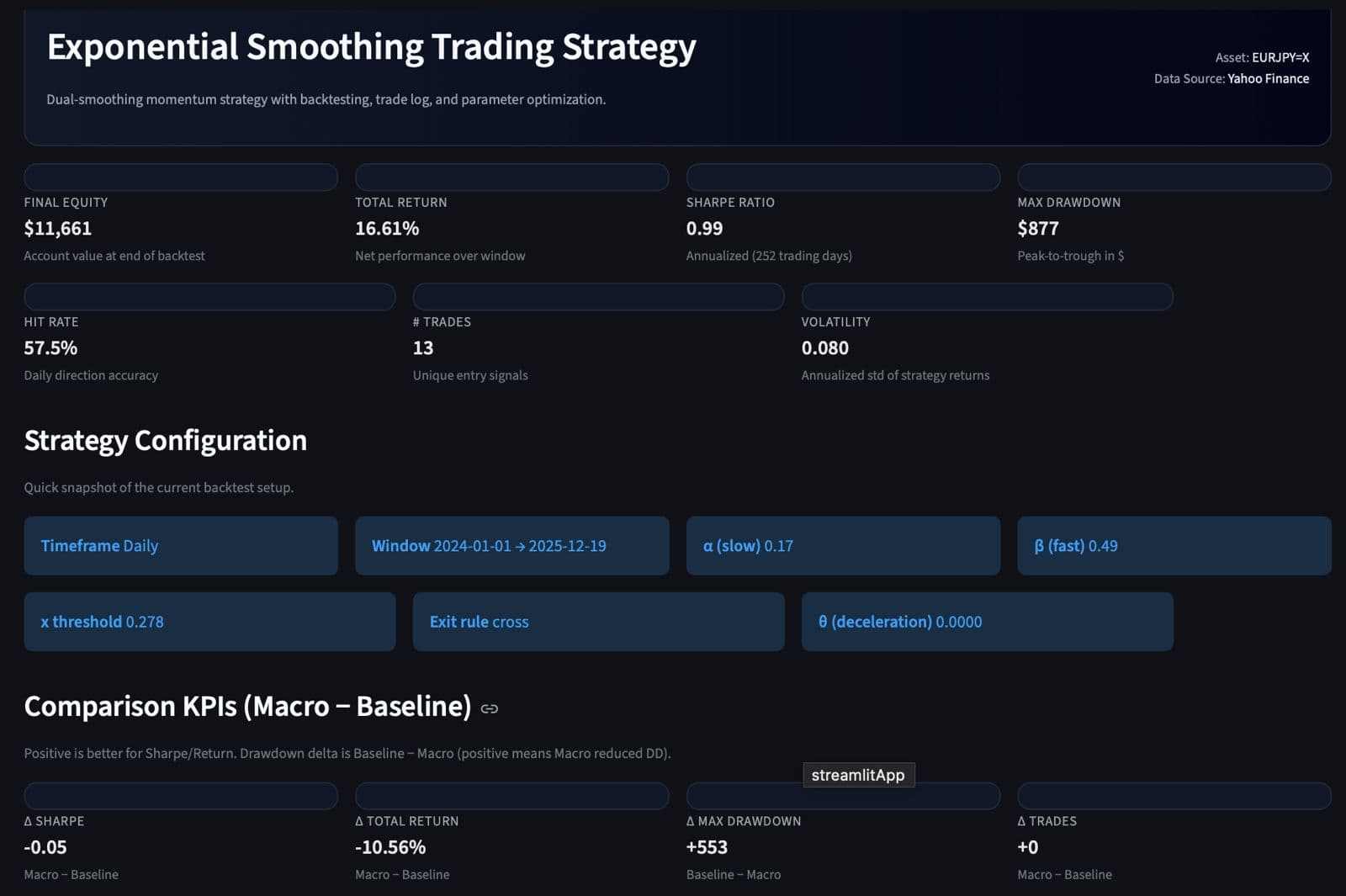

The baseline strategy is built using Exponential Smoothing models, including optimized α–β formulations, to capture short-term momentum and trend dynamics in FX price series. These models serve both as standalone signal generators and as benchmarks against which more advanced learning approaches are evaluated. Parameter optimization is performed to balance responsiveness and noise reduction, ensuring robustness across varying market regimes.

On top of the classical framework, multiple machine learning classifiers are implemented to estimate the probability that the High price exceeds a predefined profit-taking threshold relative to the Open price. These models include Random Forests, XGBoost, Long Short-Term Memory (LSTM) networks, and Temporal Convolutional Networks (TCN). Feature sets are constructed from lagged OHLC data, engineered technical indicators, and rolling statistical measures, allowing the models to learn nonlinear relationships and temporal dependencies inherent in FX markets.

The trading rule is defined in probabilistic terms: a position is entered only when the predicted probability of achieving the target return exceeds a configurable confidence threshold. This formulation enables explicit control over risk–reward trade-offs and facilitates systematic evaluation of model performance beyond raw classification accuracy. The comparative analysis highlights that while traditional smoothing methods perform well in stable regimes, deep learning models such as LSTM and TCN demonstrate superior adaptability under complex and volatile market conditions.

The entire system is deployed as an interactive Streamlit application, allowing users to select FX pairs, adjust model parameters, visualize signals, and compare strategy performance across models in real time. This deployment bridges research and practice, transforming experimental models into a usable decision-support tool for FX trading analysis.

The project concludes that integrating probabilistic machine learning models with classical time series techniques provides a powerful and flexible framework for FX signal generation. Future extensions include the incorporation of macroeconomic exogenous variables, regime detection, transaction cost modeling, and portfolio-level optimization across multiple currency pairs.